FEE-BASED ENGAGEMENT

COST | $1,500-$15,000 Flat fee

STANDARD OF CARE - We are fiduciaries when providing fee-based planning.

ENGAGEMENT - Our team will work with you to create a holistic financial plan, including the review of all relevant aspects of your current situation (goals, insurance, investments, estate planning, etc). The written plan will provide the guidance needed for you, as the client, to execute the financial decisions across multiple aspects of your planning. We will help you review and select the right advisors and product solutions to implement in your plan.

TERM OF ENGAGEMENT - One year. After, we can reengage again at our annual fee or shift to an Asset Management or Insurance Planning Engagement.

ASSET MANAGEMENT ENGAGEMENT

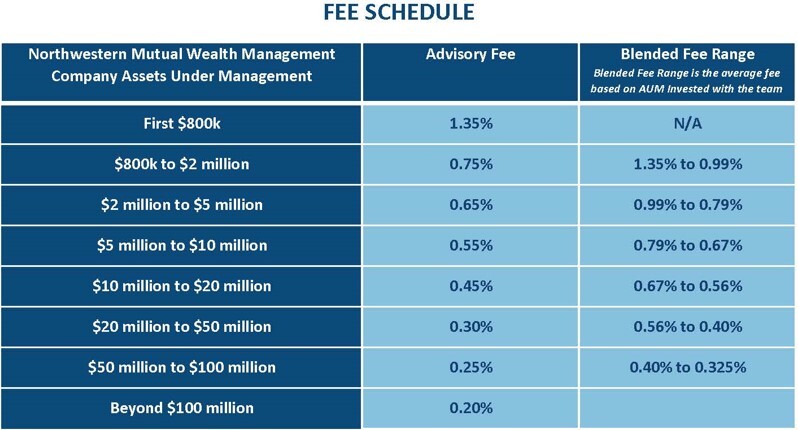

FEE PHILOSOPHY - All clients deserve a full and comprehensive plan; therefore, all engagements require a certain amount of the team's effort. Once client's assets under management reach $800,000, we reduce fees because the additional assets do not add complexity at the same rate at which some fee structures may charge. We believe this fee structure creates a fair set up for clients of all sizes which we know to be extremely competitive in the marketplace.

STANDARD OF CARE - We become fiduciaries on all advisory relationships.

TERM OF ENGAGEMENT - Ongoing. This arrangement results in an ongoing planning relationship as long as assets are being managed by Northwestern Mutual.

INSURANCE PLANNING ENGAGEMENT

COST - Commission is paid by the insurance company on any products purchased.

STANDARD OF CARE - Suitability standard of engagement (non-fiduciary).

ENGAGEMENT - Our team works within your existing plan to assess elements of risk management, tax- efficient strategies*, cash management, and design of safer asset alternatives.

TERM OF ENGAGEMENT - Ongoing. Our team will advise on and implement your risk management planning and periodically review you coverage to determine if revisions may be needed.

Fees as of 01/01/2024. Fees are calculated based on the Assets under Management (AUM) in a portfolio of assets in a billing group/household per the terms of the Northwestern Mutual Signature Advisory Programs Client Agreement. For information on fees, see the following (as applicable): The Northwestern Mutual Signature Advisory Programs Client Agreement and Statement of Investment Selection. Fees do not include any transaction fees that may apply. Fees do not include underlying management fees charged by any mutual fund or Exchange Traded Fund (ETFs). All discount percentages shown are based on market value of the applicable account at that dollar value. Discounts may change due to variances in account value. Please discuss the impact of these changes with your advisor.